Negotiating job offers

“What if they lowball my salary when I move from contractor to full-time?”

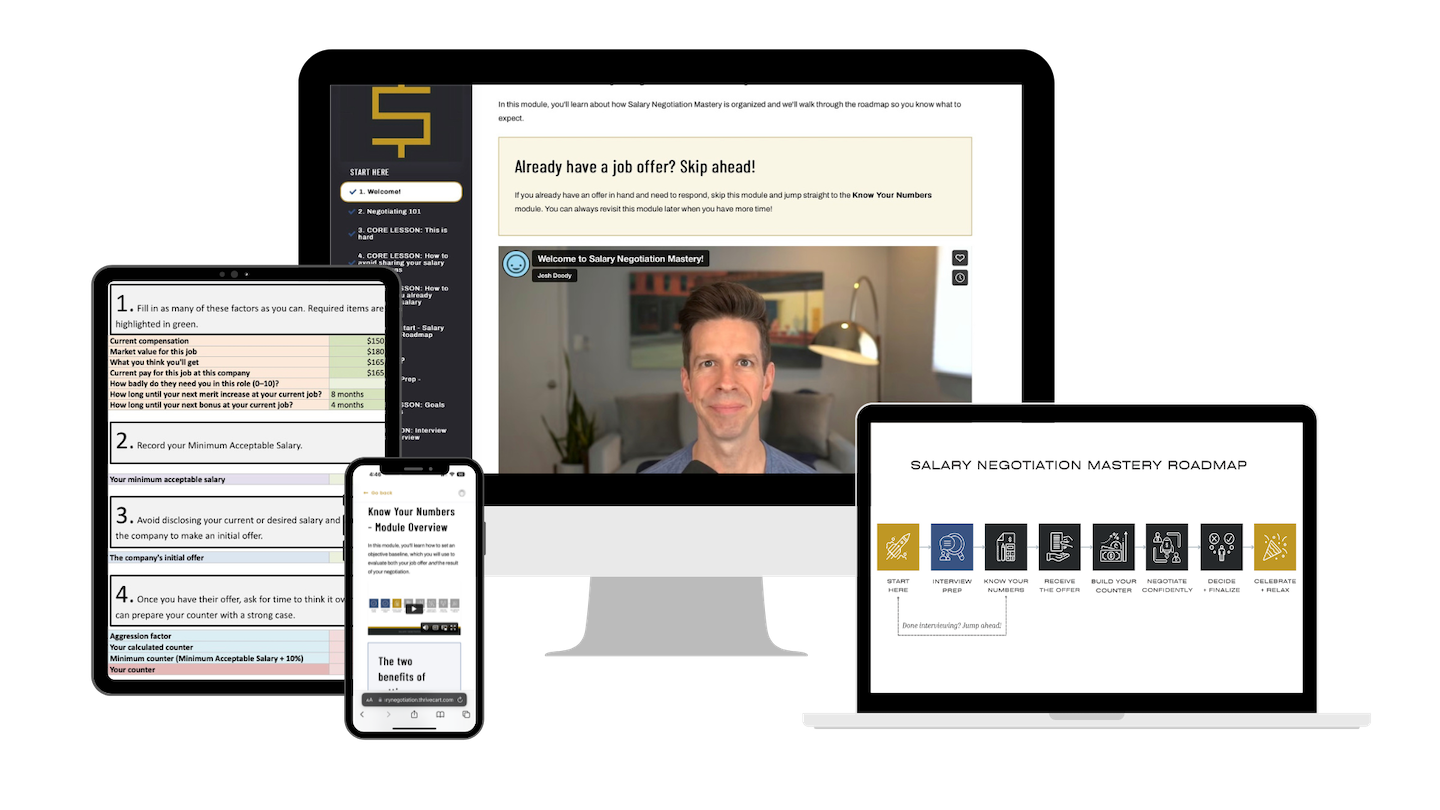

by Josh Doody

Joe recently asked me a great question:

“I’ve been a contractor for 10 months and am being hired full time to backfill for someone who is retiring. I’m currently getting paid top dollar as a contractor—$80k. The range of pay for this full-time job is $50k–70k and this company tends to make pretty low offers. I’m concerned they’re going to offer me something like $55k, which feels like a lowball offer. What do I do?”

Disclaimer

I’m not a lawyer or a labor expert. This isn’t legal advice. This is meant as a quick primer in case you’re in a pinch and need to compare a contractor position to a full-time position.

Moving from a contractor position to full-time may come with a totally new set of benefits and very different salary for doing exactly the same work. So how do you determine how much you should expect to make when moving from contractor to full-time employee or vice versa?

There are two main things you can do to make it easier to compare a contractor position to a full-time one.

1. Hourly versus salary

If you’re paid hourly as a contractor, you may need to convert that hourly pay into a salary so you can compare to a full-time salary. Here’s how I do that:

Take your hourly rate and multiply it by 2,080, which is the number of hours in a year if you work 40 hours a week for 52 weeks.

Or if you need to convert a salary into an hourly wage, you can divide the salary by 2,080.

That way, you can compare the salary for each role to each other role.

2. 1099 versus W-2

In the US, there are basically two types of employment: 1099 and W-2. When you’re a 1099 employee, that means you basically work for yourself. When you’re a W-2 employee, you work for someone else.

Why does this matter?

The employer is responsible for a lot of the cost of employing someone. If you’re a 1099 worker—you work for yourself—then you are the employer and you’re responsible for those costs and employment benefits. If you’re a W-2 worker, then you work for someone else, and they are probably responsible for those costs and employment benefits.

What sorts of costs and benefits?

Taxes are the big expense. If you work for yourself, you’re on the hook for all of your taxes. W-2 employers cover much of your tax burden before you get paid, so you may not even be aware that they’re covering such a big cost. The tax burden is often a big shock for folks who decide to go independent as a freelancer or contractor.

As a 1099 worker, you will have to buy your own health insurance, and that can be very expensive. You’ll also have to buy all of your own equipment like a computer, desk and office chair, and cell phone. And you won’t get a 401k match, and “paid vacation” doesn’t really exist for 1099 workers—if you don’t work, you don’t get paid.

Comparing contractor to full-time positions

So how do you compare two positions when one is a contractor position and one is full-time.

-

Get both opportunities into the same units for wages—you can choose either hourly or salaried. That way, you can compare the wages directly.

-

Determine whether the contractor position is a 1099 position or W-2 position so you can compare their wages.

If it’s a W-2 contract position, then you can basically compare the full-time and contractor positions directly because the employer is paying the same costs as they would if you worked for them full-time.

If your contractor position is 1099, then you’ll need to account for all of those additional costs that you’re responsible for as your own employer. In that case, a quick-and-dirty rule of thumb is you should add 50% to a W-2 wage to find its comparable 1099 wage.

Back to our example

In the example above, Joe needed to compare a contractor role paying $80k to a full-time role paying something like $55k.

He’s already using common “salary” units, so we can skip that first step.

But deciding whether a $55k offer would be a lowball offer requires knowing whether the contractor role is W-2 or 1099. Turns out his contractor role is a 1099 role, so we can’t compare those two salaries directly: One is W-2 and one is 1099.

If we add 50% to $55k—the W-2 wage he thinks they might offer—we get $82,500, and that’s a little bit more than his current 1099 wage of $80k.

Since his employer is covering some of his taxes and likely matching retirement contributions and offering paid vacation, he may take home a little more money as a W-2 worker making $55k than as a 1099 contractor making $80k.

Keep this handy for the next time you move from contractor to full-time or vice versa—it could make a tough decision much easier.